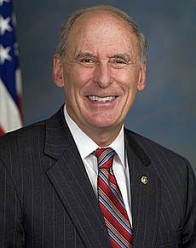

01/06/12 Senator Dan Coats (R-Ind.) Wednesday issued the following statement on the President’s appointment of former Ohio Attorney General Richard Cordray to be the head of the Consumer Financial Protection Bureau (CFPB).

01/06/12 Senator Dan Coats (R-Ind.) Wednesday issued the following statement on the President’s appointment of former Ohio Attorney General Richard Cordray to be the head of the Consumer Financial Protection Bureau (CFPB).

“President Obama is defying the constitutional authority of the legislative branch to put in place an unaccountable czar who will have the ability to impact policies directly affecting job creation and economic growth.

“Last month the Senate voted against the president’s nomination of Richard Cordray because the fundamental structure of the bureau he is tasked to lead is flawed and must be reformed to ensure transparency and effective checks and balances. Rather than work with lawmakers to address these problems, the president has taken the unprecedented step of circumventing Congress. This act is a departure from long-standing precedent and will give significant power to a single, unelected individual.”

On December 8, 2011, Senator Coats, along with 44 other senators, voted against Cordray’s nomination. The senators called for fundamental changes to the structure of the CFPB. Created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the CFPB is tasked with rulemaking, enforcement, and supervisory powers over many consumer financial products and services and the entities that sell them.

The CFPB is the only financial regulator that:

- Has a single director, who cannot be fired for policy decisions, with no board;

- Determines its own budget and spending priorities;

- Has an expansive jurisdiction that is not limited to specific entities; and

- Is not subject to an effective safety and soundness check.