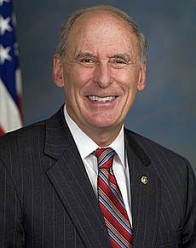

04/02/12 Senator Dan Coats (R-Ind.) called for bipartisan, comprehensive tax reform to reduce rates on individuals and businesses as the United States becomes the world leader in corporate taxation. On Sunday, Japan lowered its corporate tax rate by five percent, making the American combined tax rate of 39.2 percent the highest in the world. The average global corporate tax rate is 25 percent.

04/02/12 Senator Dan Coats (R-Ind.) called for bipartisan, comprehensive tax reform to reduce rates on individuals and businesses as the United States becomes the world leader in corporate taxation. On Sunday, Japan lowered its corporate tax rate by five percent, making the American combined tax rate of 39.2 percent the highest in the world. The average global corporate tax rate is 25 percent.

“The United States is a world leader in many ways, but topping the charts with the highest corporate tax rate is nothing to celebrate,” said Coats. “America’s high business tax rate puts our nation at competitive disadvantage, jeopardizes jobs, reduces workers’ wages and increases costs for consumers.”

“Our current tax code is an anchor dragging down potential economic growth and job creation. We need a fairer, more efficient tax system that makes companies want to invest in the United States,” added Coats. “Reforming and simplifying our outdated tax code is the best way to grow the economy and make our country stronger in the global marketplace. Senator Ron Wyden and I have introduced a comprehensive tax reform bill that encourages investment here at home, creates more American jobs and lowers rates for both businesses and individuals. Our bill is the right place to start this debate and put an end to America’s global title of highest corporate tax leader.”

Last year Coats and Senator Ron Wyden (D-Ore.) introduced the Bipartisan Tax Fairness and Simplification Act, legislation that would simplify the tax system, hold down rates for individuals and families, provide tax relief to the middle class and create incentives for businesses to grow and invest in the United States. The Wyden-Coats plan replaces the existing six corporate rates and eight brackets with a single flat rate of 24 percent.

For more information about the Wyden-Coats plan click here.