06/28/12 Indiana stud ents, parents, and higher education advocates called today for immediate action to extend the student loan interest rate. Without a new plan from Congress, on July 1st student loan interest rates will double from 3.4 to 6.8 percent. The increase would affect federally subsidized Stafford loans, which are provided to almost 7.5 million low and moderate-income students nationwide each year.

06/28/12 Indiana stud ents, parents, and higher education advocates called today for immediate action to extend the student loan interest rate. Without a new plan from Congress, on July 1st student loan interest rates will double from 3.4 to 6.8 percent. The increase would affect federally subsidized Stafford loans, which are provided to almost 7.5 million low and moderate-income students nationwide each year.

“This will impact not only me, but my whole family. I already have one son who has said he does not want to go to school because it is so expensive and he does not want to go into debt,” states Mark Cultice, a Plymouth resident and parent. “Is this fair or right?”

Joe Rust, Student Body President of Purdue University, added, “An increase in the interest rate of federal student loans is a blow to student loan borrowers and a blow to college access programs across the board.”

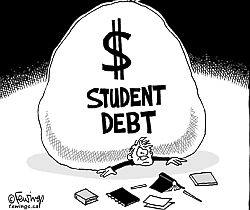

The average student borrower in Indiana already graduates with an average of $27,000 in student loans. The doubling of the interest rate would add approximately $1,000 for every year a student takes out a loan, adding up to more than $4,000 over a four-year education.

“Young people are fed up and flat broke, and if Congress doubles our interest rates it will be solid proof that we simply aren’t a priority for them. Getting an education already plunges millions of young people into a black hole of debt, and we will hold any member of Congress who votes against our best interests accountable. They shouldn’t forget that “millenials” will make up one-third of the electorate in 2016,” said Molly Katchpole, a recent college graduate and organizer with Rebuild the Dream.

To stave off the rate hike, Congress needs to act by July 1st to maintain the existing interest rate. Without action, interest rates on these loans will double, resulting in significant new debt for future graduates. A vote on the issue is tentatively scheduled in the United States Senate this week, but has been put off for almost two months now.

“Senators Lugar and Coates must take bipartisan action to stave off the rate hike on student loans,” said Sujatha Jahagirdar, advocate for INPIRG, a consumer group. “They should stop playing politics with the issue, and resolve it within the next couple of days.”