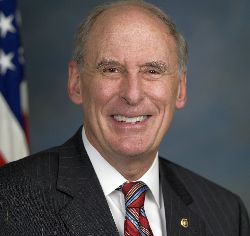

10/05/13 On Thursday, Senator Dan Coats (R-Ind.) and members of Indiana’s congressional delegation sent a letter to Senate Majority Leader Harry Reid and House Speaker John Boehner asking that full repeal of the medical device tax be included in any must pass legislation considered in the House or the Senate this year.

10/05/13 On Thursday, Senator Dan Coats (R-Ind.) and members of Indiana’s congressional delegation sent a letter to Senate Majority Leader Harry Reid and House Speaker John Boehner asking that full repeal of the medical device tax be included in any must pass legislation considered in the House or the Senate this year.

In the letter, the members write, “In Indiana, medical device companies employ over 20,000 Hoosiers. Over the last 12 years, the state has added over 5,600 jobs in the medical device industry and the medical device industry indirectly affects tens of thousands of Hoosier jobs. These jobs pay 56 percent more than the average wage in Indiana.” The lawmakers added, “We urge you to consider not only the 2,124 Indiana jobs that are lost because of this, but the 43,000 jobs nationwide, and include a full repeal of the medical device tax in any must pass legislation considered in the House or the Senate this year.”

The Indiana Medical Device Manufacturers Council added support to the delegation’s letter.

“The hundreds of medical device companies of Indiana are grateful for the attempts to repeal the medical device tax. Indiana is an international leader in medical device manufacturing, and the repeal of the medical device tax especially will allow the newer and smaller companies to maintain the production of innovative life-saving and life-enhancing products,” stated Peggy Welch, the Indiana Medical Device Manufacturers Council Executive Director. “The repeal will also help Indiana to retain and continue its creation of quality, good-wage middle-class jobs.”

Repealing the medical device tax has received broad, bipartisan support in both Chambers of Congress. In fact, the Democrat-controlled Senate approved a bill to repeal the tax, in a non-binding budget resolution, 79-20 in March. Just last year, 37 House Democrats joined their Republican colleagues to repeal the tax in a bill (H.R. 436) that passed 270-146. (ABC News; 9/28/13)

The text of the letter is included below:

October 3, 2013

The Honorable Harry Reid

Majority Leader

United States Senate

S-221, the Capitol

Washington, DC

The Honorable John Boehner

Speaker

House of Representatives

H-232, the Capitol

Washington, DC

Dear Leader Reid and Speaker Boehner,

On behalf of the people in Indiana, we are asking you to include a full repeal of the medical device tax in any must pass legislation considered in the House or the Senate this year.

In Indiana, medical device companies employ over 20,000 Hoosiers. Over the last 12 years, the state has added over 5,600 jobs in the medical device industry and the medical device industry indirectly affects tens of thousands of Hoosier jobs. These jobs pay 56 percent more than the average wage in Indiana.

During the debate on the Senate budget, 79 members of the United States Senate voted to repeal the medical device tax. The Protect Medical Innovation Act of 2013, a full repeal of the medical device tax, currently has 264 co-sponsors in the House. The message is clear; there is bi-partisan support to permanently repeal this harmful tax.

Not only is this tax costing thousands of jobs, but it is also limiting research on life saving devices. Indiana is home to over 300 medical device companies that produce lifesaving products. This tax is prohibiting their ability to conduct research or clinical trials to create new medical devices.

We urge you to consider not only the 2,124 Indiana jobs that are lost because of this, but the 43,000 jobs nationwide, and include a full repeal of the medical device tax in any must pass legislation considered in the House or the Senate this year.

Respectfully,

Senator Dan Coats

Rep. Larry Bucshon, M.D.

Rep. Susan Brooks

Rep. Luke Messer

Rep. Todd Rokita

Rep. Marlin Stutzman

Rep. Jackie Walorski

Rep. Todd Young