November 14, 2012

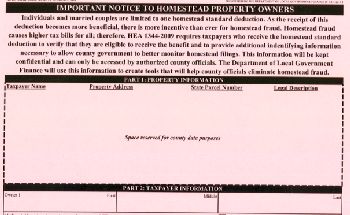

11/15/12 Property taxpayers have just under two months remaining to file the homestead verification form to continue receiving the benefit of the homestead deduction on their property tax bill. The pink or rose-colored homestead verification form was mailed with property tax bills in 2010, 2011, and 2012 and must be completed at least once prior to the January 1, 2013 deadline. “Completing the form confirms that the individual is using the property as his or her permanent home, an eligibility requirement of the deduction,” Department of Local Government Finance Commissioner, Brian Bailey said.

11/15/12 Property taxpayers have just under two months remaining to file the homestead verification form to continue receiving the benefit of the homestead deduction on their property tax bill. The pink or rose-colored homestead verification form was mailed with property tax bills in 2010, 2011, and 2012 and must be completed at least once prior to the January 1, 2013 deadline. “Completing the form confirms that the individual is using the property as his or her permanent home, an eligibility requirement of the deduction,” Department of Local Government Finance Commissioner, Brian Bailey said.

Beginning as early as January 2013, county auditors will begin sending out letters to any taxpayer receiving the homestead deduction who had not filed the homestead verification form on or before December 31, 2012. These will be notifications that the taxpayer’s homestead deduction is subject to termination.

Under Indiana law, individuals or married couples claiming the deduction must complete this form to verify their eligibility and provide identification numbers (the last five digits of both the driver’s license and social security numbers), which will be used to populate a secure homestead database and prevent homestead fraud. “The homestead deduction gives a qualifying individual or couple a substantial property tax benefit by lowering their property tax obligation,” Commissioner Bailey said. “When individuals who do not qualify receive this benefit, it costs other taxpayers more.”

The homestead deduction allows homeowners who use a property as a primary residence to qualify for a reduction of the lesser of 60 percent of the property’s assessed value or forty-five thousand dollars ($45,000), plus up to an additional 35 percent of the remaining assessed value through the supplemental homestead deduction.

Specific questions about property tax deduction eligibility or the homestead verification form should be directed to the county auditor. Additional information is available on the Indiana Department of Local Government Finance’s Web site at http://www.in.gov/dlgf/8455.htm.

Frequently Asked Questions

Q. My property is not my primary residence and I am not claiming the homestead deduction on this property. Do I need to complete the form for this property?

A. You only need to complete the form if the property is your primary residence and you are currently claiming the homestead deduction on the property. For example, if the property is a rental or second residence, the form does not need to be completed for that property.

Q. My property is my primary residence, but I have not been claiming the homestead deduction. What do I do?

A. If you wish to begin claiming the homestead deduction on the property (and are not receiving homestead benefits on any other property), you should complete an application for the deduction and file it with the county auditor.

Q. My property is not my primary residence. However, I just realized that I have been receiving the homestead on this property. What should I do?

A. You should notify the county auditor immediately and have the deduction removed from the property.

Q: I filed a Homestead Verification Form in 2010. In the last year, I sold that residence and purchased a new home and am receiving a homestead deduction on the new home. Do I need to re-file the Homestead Verification Form?

A. Yes, because this is a different homestead from the first one. You should have received a pink form with your tax bill in 2012. If you did not receive the pink form, you should contact your county auditor to complete one before the end of 2012.

Q. I purchased a property in 2012 after the property tax bills were already mailed out. Do I still need to file the pink form?

A. If, for example, you purchase a property in December, 2012 and apply for the deduction through the sales disclosure form (“SDF”), it is not necessary to file a pink form since the SDF requires the same information the pink form does and is signed under penalties of perjury. If you go into the auditor’s office to apply for the deduction for the first time in December, 2012, the auditor may – but is not required to – ask you to fill out a pink form at the same time. After December 31, 2012, however, no taxpayer should be asked to fill out a pink form since the verification program ends January 1, 2013.

Q. I don’t have a driver’s license or social security number. What should I provide on the verification form?

A. If you or your spouse (if any) does not have a driver’s license or social security number, the last five digits of a state identification number or the last five digits of a control number on a document issued by the federal government such as a passport or work visa may be provided instead. These numbers are acceptable only if an individual legitimately does not have a driver’s license or social security number and must be accompanied by an explanation of the type of number provided (i.e., passport number, work visa, state identification number).

Q. My driver’s license is from another state. Can I provide the last five digits of this number?

A. Yes. You are not required to provide an Indiana driver’s license or identification card to receive the homestead deduction. However, if you provide out-of-state identification, the county auditor may request additional information to prove the Indiana property is your primary residence.

Q. I have already provided the last five digits of my social security number and the last five digits of my driver’s license number to the county auditor. Do I still need to complete the verification form?

A. Yes. By completing the form, you are indicating under penalties of perjury that you are eligible to receive the homestead deduction on the property. In addition, you are providing your legal name (and that of your spouse, if applicable). However, you need only complete the verification form once.

Q. I am married but my spouse is not an owner of the property. Does my spouse need to provide the last five digits of his or her social security and driver’s license numbers?

A. Yes. A married couple is limited to one homestead deduction regardless of living arrangements or property ownership. Therefore, the identification numbers of both spouses are required. Only if a couple is legally divorced would both individuals be eligible for a homestead deduction.

Q. How will my identification numbers be used?

A. Your identification numbers will be used by county auditors to prevent homestead fraud. Your numbers will be entered into a secure homestead database that allows county auditors to track homesteads statewide and ensure that each individual or married couple is claiming only one homestead deduction.

Q. What happens if I do not complete the form?

A. Your homestead deduction can be removed beginning with the 2012-pay-2013 property tax bills if you do not return a completed form to the auditor on or before December 31, 2012. You must have completed the homestead verification form at least once in 2010, 2011 or 2012. If you have not completed and returned the form after the 2012 tax bills are mailed, you will receive a final notification letter from the county auditor requesting verification and identification numbers.

Q. What is the penalty for falsely claiming a homestead deduction?

A. If a taxpayer fails to notify the appropriate county auditor of his or her ineligibility for the homestead deduction, the taxpayer will be liable for any additional taxes that would have been due on the property, plus a 10% civil penalty Each county auditor that makes a determination that property was not eligible for a homestead deduction in a particular year must notify the county treasurer of the determination. The county auditor must issue a notice of taxes, interest, and penalties due to the owner and include a statement that the payment is to be made payable to the county auditor. The notice must require full payment of the amount owed within 30 days.